Next-generation liquid staking for Polygon.

3rd Sept — Shard Labs is bringing LIDO to Polygon to enable users to stake Polygon’s global token- MATIC in a decentralized and secure way and to use them on the secondary market — all of it with a simple click of a button on the UI. This integration will boost the entire ecosystem.

How does it work?

The end-user process is quite simple. The user sends their MATIC tokens to the Matic-Lido contract on the mainnet and gets the same amount of stMATIC tokens representing MATIC staking position with Lido validators. What this means is that at the same time, holders can use their stMATIC tokens in other DeFi protocols, while they also earn a stake from staking their MATIC tokens.

Lido for Polygon is enabling users to:

Stake their Matic tokens in a decentralized and secure way

Use their stMATIC on the secondary market

Do all of the above simply and easily with a click of a button on the UI

Additional value Lido can bring to the Polygon ecosystem is decentralizing stake distribution, and getting more capital efficiency in the ecosystem — enabling staked MATIC to participate in DeFi on Polygon.

Deep dive

The user will go to Lido UI and choose stake MATIC on the UI. When they do that, they will let go of the MATIC they hold and immediately receive stMATIC tokens. All the tokens are held in a pool controlled by the Lido program. This is all done on Ethereum Mainnet. In the future, Lido plans to add an option to deposit directly from Polygon and receive a stMATIC token on Polygon.

What happens in the background when a user deposits MATIC is that the Lido program collects the deposited MATIC and releases newly minted stMATIC to the user. In parallel MATIC tokens are distributed to Lido-Matic validators. The Lido DAO governs the Lido program and manages a list of validators that MATIC is delegated towards. When validators get rewards, the amount of MATIC tokens in the pool increases, along with the amount of MATIC corresponding to a 1 stMATIC token.

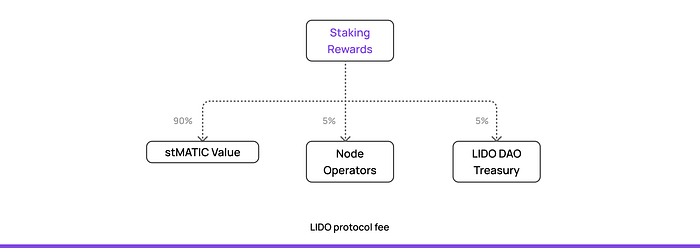

Lido protocol fee

For incentivizing Lido Matic validators, Lido implements a fee, which is as follows: 5% of the staking rewards go to Lido DAO treasury, and 5% goes to Node Operators, whereas 90% goes to the stMATIC value. Of the 5% that goes to the Lido DAO treasury, Lido proposes that 20% of that goes to Shard Labs for development and maintenance. Lido believes that this is a more sustainable long-term strategy as the team’s funding depends on the success and performance of the protocol itself.

Explanation of the above process on examples

Scenario:

We have 1000 stMATIC tokens in the pool and 1000 MATIC tokens. The exchange rate at this point is 1:1 or

1000/1000 = 1 stMATIC per 1 MATIC

After that, let’s say that Jacob deposits 100 MATIC to the pool. Jacob will get 90 stMATIC in return.

1000/1100 = 0.9 stMATIC per 1 MATIC

After some time, rewards increase the amount of staked MATIC and let’s say that rewards are worth 100 MATIC. Now in the pool, we have 1200 MATIC, which means that Jacobs 90 stMATIC are worth:

90*1200/1000 = 108 MATIC

This is a so-called share-pool approach that is adapted to the existing DeFi products.

Withdrawal process

The difference between Lido stETH and stMATIC is that first doesn’t have a withdrawal option until ETH 2.0, unlike stMATIC.

The Matic stake manager does not support unstaking an arbitrary amount of tokens. It only allows unstaking all tokens or withdrawing full rewards.

There is a spectrum of workarounds that would ensure a seamless withdrawal process despite this particular design, the exact implementation will be chosen later.

stMATIC use

With Polygon’s support, stMATIC<>MATIC pool will be created in popular AMM protocol and DEXes which will enable immediate exchange of stMATIC for MATIC and vice versa.

Governance

The protocol parameters (fees, validator selection, cover, etc) will be controlled by Lido.

About Lido

Shard Labs aims to build a future of liquid staking on Polygon and we believe that this is a win-win situation for everyone and expansion of Lido to another booming ecosystem like Polygon. Future is multichain, so is Lido. Polygon provides easy and economical transactions leveraging the blockchain infrastructure to the masses and the world.

About Shard Labs

Shard Labs is solving real-world problems using blockchain technology. Straightforward solutions to complex business challenges.

Shard is a startup founded in 2019, and since then we accompany our clients on the path to a holistic digital transformation. Profound tech knowledge coupled with business understanding is what allows us to create unique solutions.

Be a part of our social ecosystem!

Source : blog.polygon.technology