The study revealed a 3x increase in the number of Bitcoin monthly active developers and a 5x rise in the number of Ethereum developers.

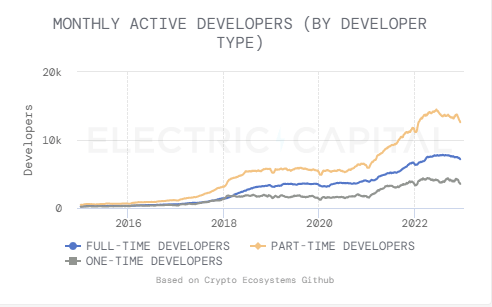

BitcoinMonthly active developers grew 5% YoY, despite a more than 70% decline in crypto prices in 2022, according to a recent crypto developer report from venture firm Electric Capital.

The report also outlined more than 8% YoY growth in Full-Time developers. The report said:

“Full-Time developer growth is the most important growth signal to track because they contribute 76% of code commits.”

Further, there were 471,000 monthly code commits toward open-source crypto.

The study also revealed a threefold increase in Bitcoin monthly active developers, from 372 to 946, and a five-fold growth in Ethereum monthly active developers, from 1,084 to 5,819. Moreover, developers in other networks like Solana, Polkadot, Cosmos, and Polygon grew from 200 to 1,000+.

Other networks are emerging beyond Bitcoin and Ethereum

With 1,873 full-time developers, Ether (ETH) remains the largest crypto ecosystem. However, about 72% of monthly active developers work outside of the Bitcoin and Ethereum ecosystems, according to Electric Capital’s data.

Polygon, NEAR, and Solana have all grown 40% YoY and have more than 500 monthly active developers combined. Further, Sui, Aptos, Starknet, Mina, Osmosis, Hedera, Optimism, and Arbitrum grew 50%+ YoY and had over 100 active developers.

There has been a 240% increase in DeFi protocol developers since ‘DeFi summer’ – 50% of whom are outside Ethereum. In addition, there have been more than 900 active NFT developers since 2021 – a 299% increase.

In total, the number of crypto developers has nearly doubled since Electric Capital released its first developer report in August 2019. The report stated:

Developers build killer applications that deliver value to end users, which attracts more customers, which in turn attracts more developers.

The firm analyzed 250 million code commits for the 2022 report, including additions, revisions, and other modifications to crypto-specific open-source software. The results consider only crypto programs performed on public projects and exclude private projects for crypto companies.

Source : cryptoslate